On-Chain Reconciliation for Tokenized Securities

Eliminating Traditional Breaks Through Smart Contracts

Introduction

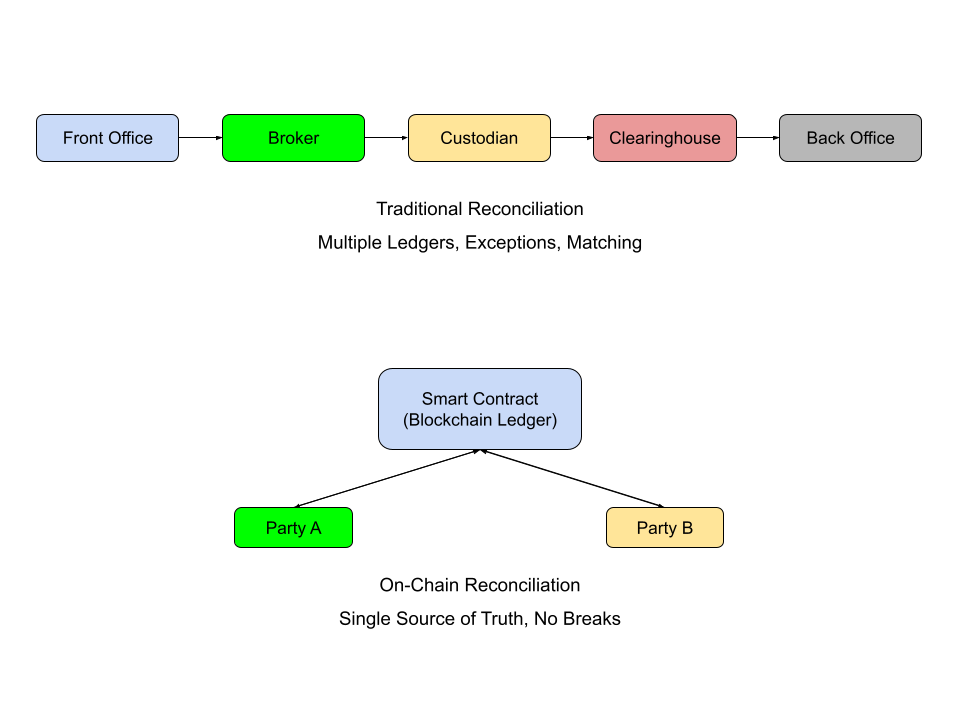

In traditional financial markets, trade reconciliation is a critical but complex process. Every security trade requires multiple independent parties—front office, broker, custodian, clearinghouse, and back office teams—to exchange files, confirm details, and ensure that what was intended to be traded matches what was executed and ultimately settled. This workflow involves numerous handoffs, reconciliation points, and exception management steps, all designed to align the “truth” across disparate ledgers.

However, the emergence of tokenized securities and blockchain-based settlement mechanisms introduces the possibility of collapsing this sprawling infrastructure into a single source of truth. Instead of maintaining separate records and comparing them, a smart contract on a blockchain can become the canonical ledger, automatically enforcing settlement rules and embedding economic details of the trade at execution. This removes the need for multi-step reconciliation, reduces settlement risk, and creates operational transparency.

This essay explores how the elimination of reconciliation steps is achieved when security trades are executed via tokenized instruments recorded on-chain, with a smart contract serving as the arbiter of economic truth.

Traditional Reconciliation: A Fragmented Ledger Problem

At the heart of reconciliation lies a structural issue: every party to a transaction maintains their own ledger. The portfolio manager’s order management system records a trade, the broker’s system records an execution, the custodian’s books reflect positions, and clearinghouses record netted settlements. Because these ledgers are siloed, reconciliation is necessary at every interface to ensure agreement on:

Security identifier (CUSIP, ISIN, token, Ticker, Ref. Data Ticker)

Trade date and settlement date

Quantity and price

Gross and net consideration

Settlement instructions

Cash and position movements

Each step introduces the possibility of breaks. Even simple mismatches in formatting (e.g., an ISIN vs ticker) or timing (e.g., late broker confirmation) generate operational overhead. Entire teams are dedicated to comparing files, chasing confirmations, resolving breaks, and reporting aged exceptions. While indispensable in today’s markets, reconciliation is essentially a workaround for fragmented record-keeping.

In short, reconciliation is not inherently value-adding—it is compensatory. The financial industry spends billions annually just to confirm that its fragmented systems are in alignment.

On-Chain Trading: A Shared Ledger

The blockchain model offers a fundamentally different architecture. Instead of each counterparty keeping its own version of the trade, there is a single shared ledger accessible by all permissioned participants. When a trade in a tokenized security occurs, the details are not just written into a firm’s proprietary system—they are encoded into a smart contract and posted to the blockchain.

This transforms the process in three key ways:

Single source of truth: The blockchain record becomes the canonical version of the trade, eliminating the need for each side to reconcile local copies.

Automated settlement logic: Smart contracts can enforce delivery-versus-payment (DvP), ensuring securities are only transferred once cash is received.

Immutable audit trail: Every action is time-stamped and transparent, removing ambiguity about who executed, affirmed, or settled a trade.

The reconciliation problem dissolves because there is no longer “my record” and “your record” to compare. There is only “the record.”

Below, Figure 1 illustrates the contrast between today’s multi-step reconciliation workflow and the streamlined on-chain mechanism.

Figure 1: Traditional reconciliation requires multiple checkpoints (top), while on-chain reconciliation collapses the process into a single smart contract execution (bottom).

The Smart Contract as Reconciliation Engine

To illustrate, imagine the life cycle of a tokenized equity trade. Two counterparties agree to exchange 1,000 tokenized shares of XYZ Corp at $10 per share. A smart contract designed for this security executes the following steps:

Order capture: Both parties digitally sign their intent and submit it to the smart contract.

Trade validation: The contract verifies both have the required balances—shares on the seller side, cash or stablecoin on the buyer side.

Economic embedding: Trade date, settlement date, quantity, price, and counterparty details are recorded directly in the contract.

Atomic settlement: On the agreed settlement date, the contract simultaneously debits and credits tokenized cash and securities, achieving DvP without intermediaries.

Finality and immutability: Once executed, the ledger reflects the new positions, visible to both parties, custodians, and regulators.

This sequence collapses the dozens of reconciliation checkpoints into a single atomic transaction. There are no broker confirmations to chase, no custodian records to align, no settlement instructions to transmit via SWIFT. The contract itself enforces the economic truth.

Mapping the traditional reconciliation flow against its on-chain replacement highlights the efficiency gain:

Order creation: Still required, but orders connect directly to the smart contract.

Execution & confirmation: Execution is recorded instantly on-chain; no separate broker file.

Trade capture & allocation: Embedded directly in the contract.

Settlement instruction: Removed, as the contract contains all logic.

Custodian matching: Obsolete; custodians read the shared ledger.

Position & cash reconciliation: Redundant; balances update atomically.

Exception management: Reduced to smart contract validation errors, handled at execution time.

The traditional reconciliation team’s role shrinks from daily fire-fighting to high-level oversight.

The Advantages, Challenges, and Considerations of On-Chain Reconciliation

Smart contracts and on-chain systems provide several advantages compared to traditional reconciliation.

Operational efficiency — Vastly fewer checks, reconciliations, and manual interventions.

Reduced settlement risk — Atomic DvP ensures no failed settlements due to insufficient securities or cash.

Cost savings — Smaller back-office footprint, fewer exception-handling staff.

Transparency — Shared, immutable ledger visible to counterparties, custodians, and regulators.

Accelerated settlement — Supports T+0 or real-time settlement, a major leap from T+2 norms.

Of course, this shift introduces new considerations:

Interoperability: If multiple chains host different assets, liquidity may fragment. Standards must emerge.

Legal recognition: Jurisdictions must formally recognize blockchain entries as binding records of ownership.

Custody evolution: Custodians will not vanish, but their focus shifts from reconciliation to safeguarding keys, monitoring compliance, and integrating off-chain and on-chain data.

Error handling: Smart contracts must have governance frameworks to address disputes, reversals, or forced regulatory actions.

Data privacy: Permissioned blockchains must balance transparency with confidentiality requirements for institutions.

Thus, while reconciliation itself disappears, oversight, governance, and risk management remain essential.

Industry Implications and Future Outlook

The broader implication of on-chain reconciliation is a structural shift in how the industry allocates resources. Today, the reconciliation “market” is enormous: technology vendors, managed service providers, and entire back-office teams are dedicated to resolving breaks. As tokenization spreads, this function shrinks. The focus moves from matching files to building secure, auditable smart contracts and shared infrastructure.

Major institutions have already recognized this trend. DTCC has piloted tokenized settlement models through its Project Whitney and Project Ion, while Nasdaq has announced platforms for tokenized assets that integrate directly with its market infrastructure. Just this past November, Morgan Stanley released their JPM Coin, making it the first bank to issue USD deposit tokens on a public chain, enabling its use in real-time, on-chain trade reconciliations. These initiatives demonstrate that incumbents are preparing for a transition where reconciliation is no longer a market function but an architectural feature.

Industry experts are already predicting how reconciliation’s evolution will play out. SEC Chair Paul Atkins believes tokenization will become central to US markets in “a couple of years.” Many foresee on-chain systems gradually replacing the Automated Clearing House (ACH) system altogether, with Custodia Bank CEO Caitlin Long projecting it will be obsolete within five years. She expects this transition to begin with banks as they begin to adopt primitive tokenization and blockchain systems, providing a foundation for others to build off until the technology becomes commonplace across capital markets. Figure Co-Founder Mike Cagney believes the emergence of blockchain will create financial ecosystems for assets that for the first time can be made liquid, creating both disruption and great opportunity. These new architectures have the potential to restructure entire markets.

Conclusion

Tokenized securities and blockchain settlement redefine the role of reconciliation, changing the very architecture of the market. Instead of reconciling thousands of records daily, firms can design, audit, and monitor smart contracts to enforce economic truth by default. Custodians can focus on safeguarding digital assets, regulators gain real-time transparency, and investors see reduced costs and risks. With smart contracts encoding trade economics and atomic settlement, reconciliation ceases to be a manual process and becomes inherent in the system’s design. For the first time, capital markets could achieve what decades of reconciliation teams have worked toward: complete alignment of economic truth across all participants.

I do not expect the reconciliation market to fall off a cliff in the near future; legacy systems and operational inertia will ensure it persists for some time. However, with institutions such as DTCC and Nasdaq actively working to tokenize every security, the inevitable is arriving much sooner than most expect. The back office of the future will be coded into the contract itself, and reconciliation as we know it will steadily fade into obsolescence.

How soon do you think the transition will occur? Will these new systems bring about true disintermediation, or will traditional structures persist for longer than experts are predicting?

Leave your thoughts in the comments below and keep the conversation going!

This article was written by Roque Martinez, CTO of Frontier Foundry. Visit his LinkedIn here.

To stay up to date with our work, visit our website, or follow us on LinkedIn, X, and Bluesky. To learn more about the services we offer, please visit our product page.